In Verhandlungen mit Finanzierungspartnern zählen Daten und Fakten. Doch es geht auch darum, diese im richtigen Zusammenhang zu präsentieren, damit Sie schnell und zuverlässig Ihre Finanzierungszusage erhalten.

Wir entwickeln für Sie die passenden Finanzierungskonzepte und erörtern diese dann gemeinsam mit Ihnen. Dabei ist es grundsätzlich das Ziel, Zinsbindungen, Tilgungen und Derivate so zu kombinieren, dass mit optimalem Eigenkapitaleinsatz die maximale Finanzierungshöhe erreicht wird. So wird nicht nur die Rendite gesteigert, sondern auch freie Liquidität für weitere Investitionen gewonnen.

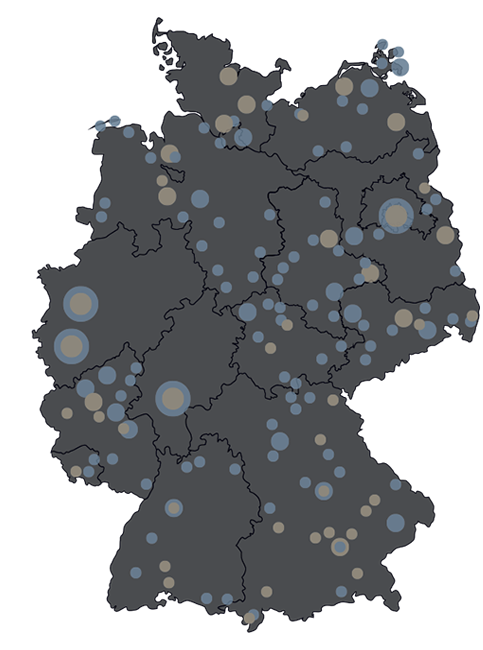

Als Spezialisten für gewerbliche Immobilienfinanzierungen haben wir dieses Ziel immer im Blick. Wir kennen nicht nur die dafür passenden Produkte und deren Kosten, sondern wir wissen auch, worauf Ihre Gegenüber in den Kreditverhandlungen achten, weil wir diese persönlich kennen und auf jahrelange Erfahrung zurückgreifen können. Eine unserer besonderen Stärken ist ein dichtes Netzwerk aus Sparkassen, Banken, Versorgungskassen, Versicherungen und privaten Geldgebern.

Die optimale Finanzierungsstrategie ist neben dem Kaufpreis, dem Mietzins und der entsprechenden Objektqualität der Immobilie ein wesentlicher Baustein für den Erfolg Ihres Vorhabens.

Auch die Frage, mit welchem Projektpartner sich Ihr Vorhaben bestmöglich umsetzen lässt, wird häufig unterschätzt. Doch genau an diesen Stellschrauben liegt der Schlüssel zum Erfolg. Wir sind aufgrund unserer analytischen Kompetenz, unserem belastbaren Netzwerk und unserer 35-jährigen Erfahrung genau der richtige Partner, der Ihr Immobilien-Invest durchoptimieren und realisieren kann.

Als vorausschauender Investor sollten Sie in regelmäßigen Abständen Ihr bestehendes Kreditportfolio analysieren, dessen Struktur aktiv optimieren und auf veränderte Markt- und Zinsszenarien überprüfen. Hierbei unterstützen wir gerne und sorgen dafür, dass die Ertragskraft Ihrer Immobilie nachhaltig gesteigert und Ihre Eigenkapital-Rendite erhöht wird.

Als führender Spezialist auf diesem Gebiet sind wir in der Lage, zu jeder Zeit individuelle Lösungen zu entwickeln, die zu Ihrem gesamten Finanzierungs-Portfolio passen.

Wir analysieren Ihr Vorhaben und evaluieren den potenziellen Mehrwert durch die P.A. Finanzierungsberatung

Gemeinsam stimmen wir die Gestaltung aller vorliegenden Unterlagen ab

Ggf. Erstellung alternativer Finanzierungsmöglichkeiten (Festschreibung, Tilgung, Haftung, Finanzierungsauslauf etc.)

Wir erarbeiten für Sie eine optimale Präsentation für Finanzierungsinstitute

Wir präsentieren Ihnen sämtliche Ausschreibungsergebnisse und verhandeln mit den Finanzierungsinstituten

Wir beschaffen für Sie sämtliche Vertragsunterlagen und Anlagen (z.B. Grundschuldbestellung, etc.)

Wir achten auf die Einhaltung aller vertragsrelevanten und vorbesprochenen Themen und begleiten Sie bis zur Auszahlung der Finanzierung

It is often technical parameters such as the amount of repayment, interest rates, and maturities that determine the return on the equity invested.

Regulatory requirements and the interaction of the partners involved are also decisive. This is because credit institutions are often subject to stricter regulations on lending than pension funds, private lenders, or insurance companies.

We are familiar with the regulatory challenges of all potential project partners and are therefore able to identify the perfect financing partner for your project. With this we can position it in such a way that it fits seamlessly into their loan portfolio. This enables us to achieve conditions that often far exceed your expectations. In addition, we can show you ways to optimise your real estate portfolio from a tax and corporate law perspective as our extensive network of tax and law firms as well as other experts will be happy to help you.

“We are an expert team that takes into account the tax and legal aspects of your real estate project and works with you to make it a success.”

Asset transfer is about life achievement, about gratitude, about family, sometimes about justice, and always about emotions.

In practice, it is about finding the right answers to important questions and the right solutions when you want to pass property on to family, friends, or trusts.

We can support you in this endeavour and show you effective concepts for a strategic transfer of assets. We can work with you to ensure that your real estate is transferred in the most effective manner from a tax and company law perspective. We coordinate with your advisors and offer you our tried-and-tested network of specialised tax law and law firms, as well as notaries and surveyors. We will guide all parties involved in the process to an end result most desirable for you. With our experience and knowledge of the most effective processes and procedures, we will save you time and money.

We are the most significant consultancy for commercial real estate investments in Germany.